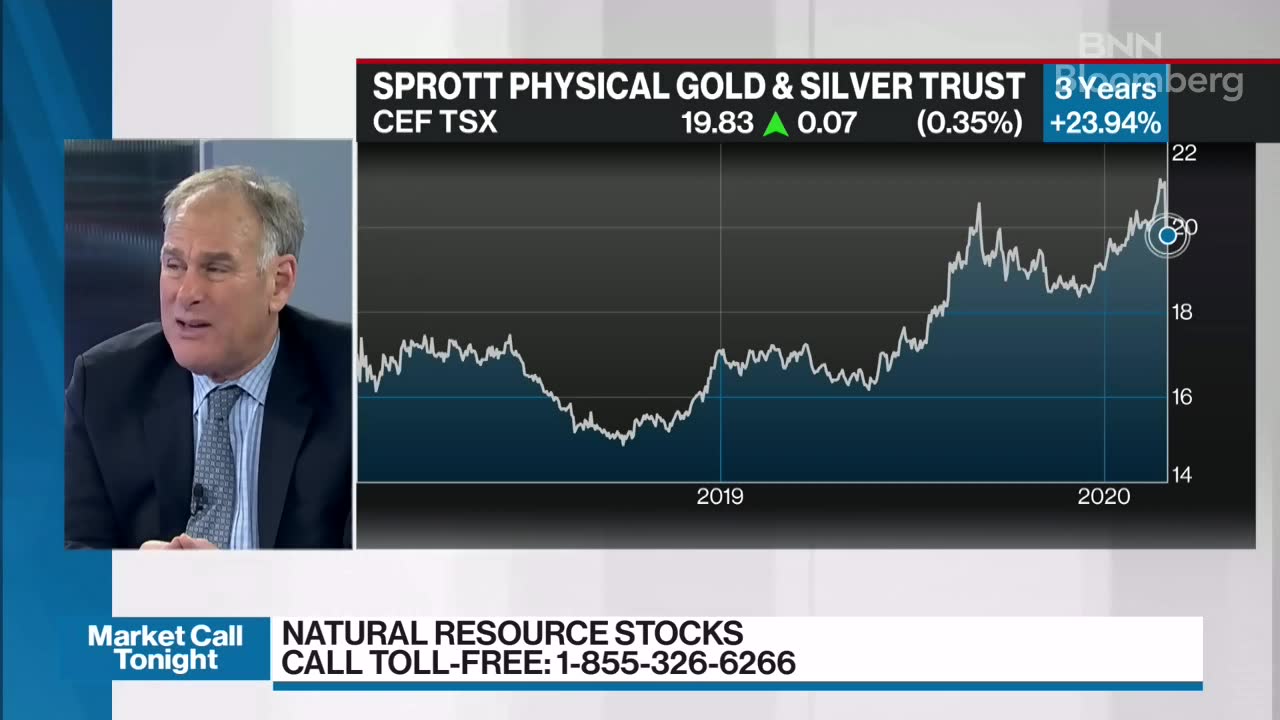

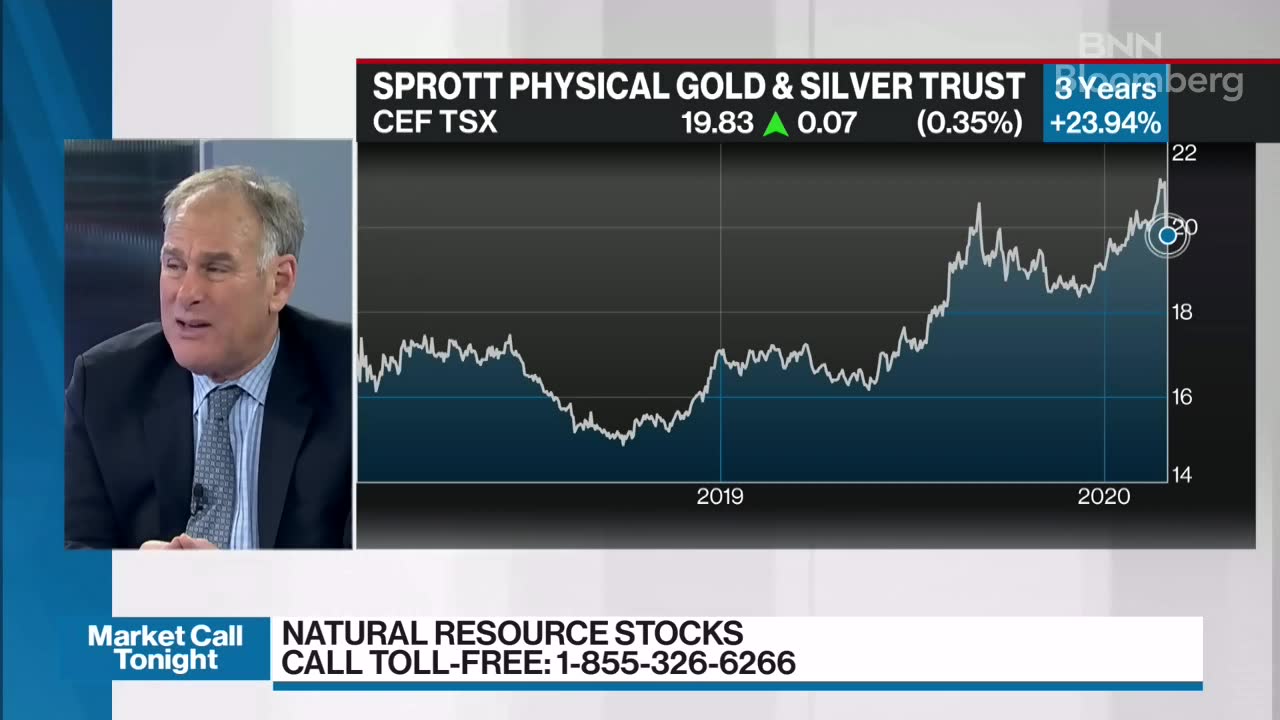

Market disruptions resulting from covid 19.

Leveraged silver etf canada.

A silver etf should closely track the performance of the silver index for the physical commodity.

An actual market example of how direxion leveraged etfs seek daily investment results.

Gold and silver is a soaring sector and interest in canadian gold and silver etfs has done nothing but grow.

The global x silver miners etf gives investors access to many silver mining companies.

The silver etf universe is comprised of 4 etfs excluding inverse and leveraged etfs.

Silver futures have dramatically outperformed the market in the past year with a 1 year price change of 56 8.

A detailed explanation as to how these funds operate as well as a the composition risks benefits of leveraged etfs.

Each inverse etf seeks a return that is 100 of the performance of its target.

With the launch of many new etfs in the precious metals industry canadians are presented with a lot of choices when it comes to selecting an etf.

Etf issuers are ranked based on their aggregate 3 month fund flows of their etfs with exposure to silver.

An example of daily investment results.

The funds use futures contracts to accomplish their goals and can be either long or inversed.

It benefits from the fact that those companies can enjoy quick gains when the price of the metal is rising.

3 month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of different etf issuers with etfs that have exposure to silver.

All values are in u s.

Likewise a silver mining etf should track and magnify the gain and losses of silver as it rises.

The direxion shares etfs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk consequences of seeking daily leveraged or daily inverse leveraged investment results and intend to actively monitor and manage their investment.

The level of magnification is included in their descriptions and is generally 2x or 3x or 2x or 3x.

For more information about a particular metals leveraged etf click on the fund name.

Each leveraged and inverse leveraged etf seeks a return before fees and expenses that is either up to or equal to either 200 or 200 of the performance of a specified underlying index commodity futures index or benchmark the target for a single day.